Hey! So this is kind of a weird one to review because I wasn’t even planning to look at Retirement Millionaire. My dad subscribed and kept forwarding me emails from “Doc” that I honestly just deleted for about six months.

But then around Thanksgiving 2021 he wouldn’t stop talking about his portfolio gains and how this newsletter is “the real deal” and I should write about it. So fine, Dad. Here’s your review.

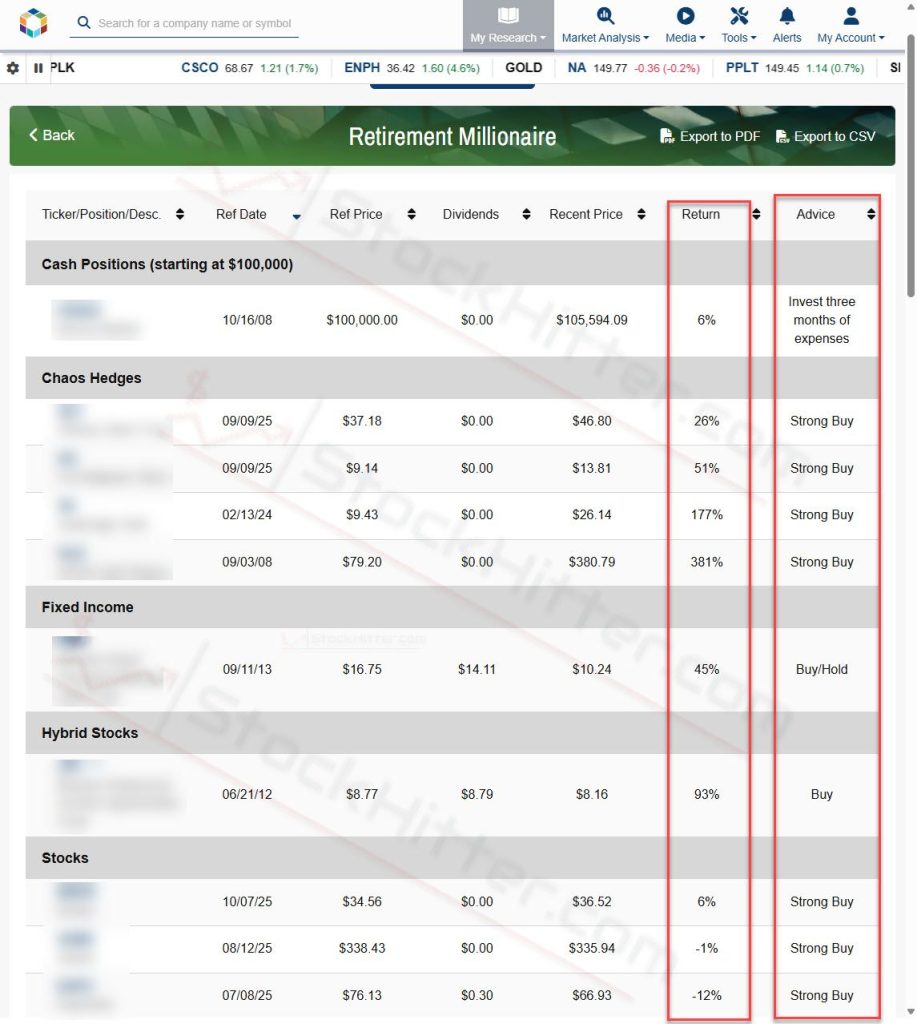

I’ve had access to his account since November 2021. Over the past 4+ years, I’ve gone through the back issues, tracked the model portfolio, and watched dozens of positions play out. What you’re reading below is based on an actual portfolio export dated February 18, 2026 showing all 39 open positions with real returns. Not marketing claims. Not “based on research.” Data straight from the Stansberry Research members area.

Retirement Millionaire Review: Is Dr. David Eifrig’s Newsletter Legit? (February 2026 Update)

Quick Specs: Retirement Millionaire at a Glance

| Metric | Retirement Millionaire (As of Feb 18, 2026) |

|---|---|

| Access Since | November 2021 (4+ years via dad’s subscription) |

| Total Open Positions | 39 active recommendations across 4 categories |

| Best Performer | +1,344% (Major software company, held since Nov 2010) |

| Second Best | +789% (Conglomerate, held since Apr 2009) |

| Worst Current Position | -25% (Life sciences company) |

| Positions in the Green | 33 of 39 (85%) |

| Positions in the Red | 6 of 39 (15%) |

| Oldest Open Position | September 2008 (17+ years and counting) |

| Partial Profit Takes | MSFT sold half at +1,200% (Aug 2023), SLV sold half at +82.2% (Feb 2026) |

| Portfolio Categories | Chaos Hedges, Fixed Income, Hybrid Stocks, Stocks |

| Price | $79 promo / $199 renewal |

| Refund | 30 days |

Best for: Retirees, pre-retirees, conservative dividend investors, long-term holders | Not for: Day traders, aggressive growth chasers, anyone who can’t hold positions for years

What Is Retirement Millionaire?

I joined, so I can show you!

David Eifrig’s Retirement Millionaire is a monthly investment newsletter published by Stansberry Research that’s been around since 2008. It comes out on the second Wednesday of each month with stock picks, investment ideas, and market analysis designed to help retirees grow and protect their wealth.

The whole focus is conservative, low-risk investment strategies mixed with health and wellness advice. Doc calls it the “millionaire lifestyle” approach. Which is why my dad loves it. He’s been freaking out about having enough money for retirement, and Doc’s approach is designed for exactly that mindset.

Price is normally $199 per year but they run promotions constantly. Right now it’s $79 with bonus reports about gold and uranium tied to a “Mar-a-Lago Accord” theme. Classic Stansberry Research sales funnel stuff (Porter Stansberry built the company on aggressive marketing), but the core newsletter behind it is one service where the actual content is legit.

Is Dr. David Eifrig from Stansberry Research Legit?

Yeah, David Eifrig is legit. He worked at Goldman Sachs on Wall Street as a derivatives trader, then randomly became a doctor. Like actually went to med school at University of North Carolina at Chapel Hill. Has an MBA from Northwestern University’s Kellogg School of Management too. He’s basically that overachiever who makes everyone else feel bad about their life choices.

What convinced me more than any bio was the actual portfolio data. When I exported the model portfolio on February 18, 2026, it showed 33 out of 39 positions in the green (85% win rate on open positions). The longest-held position has been running since September 2008. That’s 17+ years on a single recommendation. You don’t maintain a portfolio like that if you don’t know what you’re doing.

His track record shows both winners and losers, which I appreciate. The transparency is better than most investment advisory services that only highlight their best picks. You won’t find a single testimonial on this page that isn’t backed by real portfolio data.

How I’ve Been Tracking This: My Methodology

My dad subscribed before November 2021. I’ve had access to his account since then and have been following the portfolio, reading the monthly issues, and watching positions develop for over four years.

The portfolio data below comes from an official Stansberry Research export dated February 18, 2026 at 7:02 PM. Every ticker, every return percentage, every entry date is directly from their tracking system.

Since Stansberry keeps the full portfolio visible to subscribers (unlike some services that hide closed trades), I have a complete picture of all 39 open positions. For the legacy blue-chip positions held 5+ years, I’ll share more detail since those recommendations are well-known. For newer picks from 2024-2026, I’ll use sector descriptions to protect the subscription value.

Performance results shown are from the Retirement Millionaire model portfolio as exported from Stansberry Research. Past performance does not guarantee future results. This is not investment advice.

The Model Portfolio: What 17 Years of Picks Actually Looks Like

This is the part Stock Gumshoe’s 400+ user reviews can’t show you. Not opinions about the newsletter. Actual positions with actual returns. Let’s break it down by category.

The Legacy Blue-Chip Holdings (The Big Winners)

These positions have been in the portfolio for years. They demonstrate what conservative, long-term investing actually delivers when you have the patience to hold:

| Description | Recommended | Total Return (incl. dividends) | Status |

|---|---|---|---|

| Major software company (sold half at +1,200% in Aug 2023) | Nov 2010 | +1,344% | Strong Buy |

| Famous conglomerate/holding company | Apr 2009 | +789% | Strong Buy |

| Big Tech / search and AI giant | Dec 2016 | +648% | Strong Buy |

| Gold ETF (SPDR) | Sep 2008 | +479% | Strong Buy |

| Medical tech and devices fund (Fidelity) | Sep 2008 | +393% | Strong Buy |

| Major e-commerce / cloud company | May 2017 | +330% | Strong Buy |

| Top US bank | Apr 2017 | +301% | Strong Buy |

| Gold mining company | Feb 2024 | +251% | Strong Buy |

| Uranium ETF | Jul 2022 | +215% | Strong Buy |

| Industrial distribution giant | Nov 2020 | +191% | Strong Buy |

Read that table again. These aren’t speculative bets. They’re blue-chip stocks, gold ETFs, and income funds. The kind of boring, conservative picks that retirees should be holding. And they’re crushing it.

The partial sells are worth highlighting: Doc recommended selling half the major software position in August 2023 at a +1,200% gain. The remaining half is now at +1,344%. They also sold half of a silver trust position on February 12, 2026 at an 82.2% gain. Same playbook: take profits on part of the position, keep the rest running. That’s disciplined portfolio management you rarely see from newsletter services.

The Chaos Hedges (Precious Metals Protection)

Doc maintains “Chaos Hedges” designed to protect against market volatility and inflation. Every single one is in the green:

| Description | Recommended | Total Return | Status |

|---|---|---|---|

| Gold ETF | Sep 2008 | +479% | Strong Buy |

| Gold mining stock | Feb 2024 | +251% | Strong Buy |

| Silver mining stock | Sep 2025 | +147% | Strong Buy |

| Silver trust ETF (sold half at +82.2% on 2/12/26) | Sep 2025 | +85% | Hold |

A 479% return on gold since 2008. A silver mining stock up 147% in under six months. Doc’s been calling the precious metals rally for years, and the data backs it up. My dad was too nervous to go heavy on gold and silver early on. He regrets that now.

The Income Plays (Fixed Income and Hybrid Stocks)

For retirees who need cash flow, Doc includes dividend funds and preferred stock positions:

| Description | Recommended | Total Return (incl. dividends) | Status |

|---|---|---|---|

| Preferred & income opportunities fund | Jun 2012 | +106% | Buy |

| High yield equity dividend fund | Apr 2016 | +105% | Strong Buy |

| Emerging markets debt fund | Sep 2013 | +54% | Buy/Hold |

These won’t make headlines. But a retiree who needs steady quarterly income? A preferred income fund that’s doubled (including dividends) since 2012 is exactly what that portfolio needs.

The Mid-Term Performers (2019-2024 Picks)

| Description | Recommended | Total Return | Status |

|---|---|---|---|

| Logistics / shipping company | Oct 2019 | +123% | Strong Buy |

| Professional tools manufacturer | Jul 2024 | +55% | Strong Buy |

| Emerging markets ex-China fund | May 2021 | +54% | Strong Buy |

| Industrial filtration company | Mar 2024 | +53% | Strong Buy |

| Consumer food company (two buy tranches) | Dec 2023 / Jan 2025 | +32% combined | Strong Buy |

| Internet domain registry | Aug 2024 | +26% | Strong Buy |

| Online dating platform | Dec 2017 | +25% | Strong Buy |

| Farmland REIT | Jun 2024 | +24% | Strong Buy |

Recent Picks (2025-2026) and the Losers

Now the reality check. Not everything works, and I’d be lying if I hid the red:

| Description | Recommended | Total Return | Status |

|---|---|---|---|

| Aluminum manufacturer | Nov 2025 | +80% | Strong Buy |

| Welding/electrical equipment maker | May 2025 | +49% | Strong Buy |

| Electrical components manufacturer | May 2025 | +36% | Strong Buy |

| Genomics/biotech company | Jun 2025 | +36% | Strong Buy |

| Networking/telecom giant | Feb 2025 | +28% | Strong Buy |

| Construction/engineering services | Dec 2025 | +26% | Strong Buy |

| Consumer beverage company | Apr 2025 | +20% | Strong Buy |

| Medical devices giant | Oct 2022 | +19% | Strong Buy |

| Security/access control company | Nov 2024 | +16% | Strong Buy |

| Scientific instruments company | Oct 2025 | +15% | Strong Buy |

| Water utilities | Jan 2025 | +11% | Strong Buy |

| Financial software provider | May 2023 | +8% | Strong Buy |

| Manufactured housing REIT | Feb 2026 | +1% | Strong Buy |

And now, the losers:

| Description | Recommended | Total Return | Status |

|---|---|---|---|

| Creative software company | Aug 2025 | -22% | Strong Buy |

| Life sciences / diagnostics company (incl. spinoff) | Sep 2022 | -13% combined | Strong Buy |

| Engineering consulting firm | Jul 2025 | -7% | Strong Buy |

| Timber REIT | Jun 2024 | -6% | Strong Buy |

| Nuclear technology company | Jan 2026 | -4% | Strong Buy |

That’s reality. The creative software company is down 22%. The life sciences position (which includes a spinoff) is down 13% combined. The timber REIT is underwater. Not every pick works out, even with solid research. Anyone who tells you otherwise is selling you something.

But here’s the honest math: 33 winners vs. 6 losers. An 85% hit rate on open positions. And the scale of the winners (multiple positions up 200-1,344%) dwarfs the losses (worst at -25%). That asymmetry is what makes long-term conservative investing work.

What My Dad’s Portfolio Actually Looks Like

My dad follows maybe 15 of these positions. He’s up about 20-25% overall since he started subscribing. Not amazing compared to the model portfolio’s home runs, but he missed the big tech giants because he got in way too late and was too nervous for the precious metals plays.

That’s the honest truth about any newsletter: the model portfolio assumes you bought every pick at the recommended price on the recommended date. Real subscribers cherry-pick, hesitate, and enter late. Your personal investment results will vary based on your own investment decisions. But even with my dad’s selective approach, he’s sleeping way better than when he was trying to pick growth stocks himself.

What You Get With a Retirement Millionaire Subscription

Monthly Newsletter and Stock Picks

The monthly newsletter includes new investment recommendations with detailed analysis. Each of the newsletter issues explains the investment thesis, business model, competitive advantages, and risks. Not just “buy this ticker symbol.”

Recent issues covered healthcare companies, dividend-paying stocks, defensive positions against inflation, and international equities that most American investors completely ignore. Doc’s writing is easy to follow and well-researched. My dad can understand it and he barely knows what a P/E ratio is.

Each recommendation includes the ticker symbol, buy-up-to price, and actionable, step-by-step supporting research with practical advice on position sizing. The quality is well above free newsletters.

Special Reports and Bonuses

New subscribers get several special reports with the current promotion:

- The No. 1 “Mar-a-Lago Accord” Gold Stock

- How to Play Silver’s Mar-a-Lago Mania

- The “America First” Nuclear Renaissance (uranium stock)

- The Big Book of Retirement Secrets (672-page comprehensive guide)

The Big Book of Retirement Secrets is actually useful. It covers healthcare planning, investment strategies, and practical retirement advice. Haven’t read all 672 pages (who would?) but the parts I skimmed seemed solid.

The bonus reports feel more promotional, tied to whatever macro theme Stansberry is currently pushing. They’re fine for understanding Doc’s investment thesis, but take those 1000% upside projections with a grain of salt.

Health and Wealth Bulletin

Doc sends a daily Health and Wealth Bulletin with market commentary, health tips, and financial advice for retirees. The “living well” angle covers topics from reducing medical costs to improving sleep quality and overall quality of life. Some of it’s random (there was one about something in your closet that prevents flu… still don’t know what he meant by that).

My dad deletes most of these daily emails. If you want the holistic health and wealth approach, the bulletin adds value. If you just want stock picks, it becomes inbox clutter.

Portfolio Updates Throughout the Month

Doc sends updates when positions hit targets, need adjustments, or should be closed. The portfolio is updated every Monday with current prices and status. These updates matter because market conditions change and you need to know if a “Strong Buy” has shifted to “Hold.”

The Retirement Millionaire Track Record: An Honest Assessment

What the numbers show: The newsletter’s 39 open positions break down to 33 winners (85%) and 6 losers (15%). Top performers include gains of 1,344%, 789%, 648%, 479%, and 393% on major U.S. stocks and ETFs. These are positions held for years to decades. The worst current loss is -25% on a life sciences company.

The partial profit-taking strategy works: Selling half the major software position at +1,200% in August 2023 and half the silver trust at +82.2% in February 2026 shows Doc doesn’t just set and forget. He actively manages exits.

The conservative approach avoided 2022 pain: While growth-focused newsletters got destroyed during the 2022 market downturn, Doc’s emphasis on value, dividends, and precious metals hedges limited the damage.

Time horizon is everything: Doc’s best picks took years to pay off. The top performer has been held since 2010 (16 years). If you need quick gains, this isn’t it.

The “126% average” claim needs context: That number only counts current open positions. It’s a real number from the portfolio, but it’s weighted heavily by those legacy blue-chip monsters. The recent picks from 2025-2026 range from +80% to -22%. Don’t expect 126% returns on the next pick.

My dad’s real-world result: Following roughly 15 positions, he’s up 20-25%. Not the model portfolio’s theoretical returns, but better than he was doing on his own. And he’s not losing sleep anymore.

Is Retirement Millionaire Worth the Cost? (Pricing, Refund, and Fine Print)

At $199 per year normally, this sits mid-range for investment newsletters. The promotional pricing at $79 makes it easy to try. That’s under $7 monthly for the newsletter, model portfolio access, special reports, and daily bulletin.

One decent pick could easily cover the annual cost. The gold mining stock recommended in February 2024 is up 251% as of this writing. A $1,000 position there would have turned into $3,510. At $79 per year, the math isn’t complicated.

Here’s the catch and the fine print most reviews skip: the subscription automatically renews at $199 per year after the first year. Set a calendar reminder or you’ll get charged the higher rate. This isn’t unique to Stansberry, but at $199 the stakes are higher than your typical subscription.

One thing the Retirement Millionaire newsletter doesn’t publish openly is closed recommendations. The portfolio shows all 39 open positions, but positions that were stopped out or sold entirely get removed. I’d prefer full transparency on closed trades too, but what’s visible is still more than most newsletter services show.

If you’re young and focused on aggressive growth stocks or day trading, your money is better spent elsewhere. Retirement Millionaire is specifically designed for its target audience.

They offer a 30-day refund policy. If you’re unhappy for any reason, contact customer service within 30 days for a full refund.

Retirement Millionaire Pros and Cons

What Works

What Doesn’t Work

My Retirement Millionaire Review and Final Verdict

Retirement Millionaire is a legitimate newsletter for its target audience. The numbers back that up: 85% of positions in the green, multiple positions delivering triple and quadruple-digit returns, and a precious metals hedge strategy that’s been running since 2008 with a perfect record.

Dr. David Eifrig’s background combining Goldman Sachs trading with medical expertise brings a genuinely unique perspective. The focus on both wealth and wellness makes sense for retirees planning holistically, even if the daily health emails get a little random.

The key insight from tracking this portfolio for 4+ years: time is the real edge. Doc’s best picks weren’t flashy. They were boring blue-chips, gold ETFs, and dividend funds that compounded for years. The subscribers who got rich from this newsletter aren’t the ones who jumped in and out. They’re the ones who bought and held.

At the promotional price of $79, it’s worth trying if you fit the target demographic. The 30-day refund policy means minimal risk. Even one successful pick could justify years of subscription costs.

But if you’re young and focused on aggressive growth, or just want high-risk recommendations, look elsewhere. This is designed for building a stable retirement through conservative investing. Hence the name.

Just remember the subscription automatically renews at $199 per year. Set a reminder if you want to cancel before renewal. And ignore most of Stansberry Research’s marketing emails. The actual newsletter content is much more measured than their dramatic sales pitches suggest.

Frequently Asked Questions

Is Retirement Millionaire worth $199 per year?

For retirees actively managing a portfolio, yes. At $79 promotional pricing, it’s a no-brainer to test. The gold mining stock recommended in February 2024 is up 251%. One position like that pays for decades of subscription costs. The value drops if you only want aggressive growth picks or can’t hold positions for years.

How accurate is Doc’s track record?

As of February 2026, 33 of 39 open positions are profitable (85%). Top performers range from +105% to +1,344%. The worst current loss is -25% on a life sciences company. The “126% average” cited in marketing materials is real but skewed by legacy positions held for 10-17 years. Newer picks show a wider range from +80% to -22%.

What’s the biggest risk with Retirement Millionaire?

Time horizon mismatch. Doc’s best picks took years to deliver. If you subscribe expecting quick gains, you’ll be disappointed. The model portfolio’s top performer has been held since November 2010. The approach is fundamentally built around patience and compounding.

How does Retirement Millionaire compare to other Stansberry newsletters?

It’s the most conservative option in the Stansberry lineup. While other Stansberry services chase aggressive growth or speculative plays, Retirement Millionaire focuses on capital preservation with steady growth. The “Chaos Hedges” (precious metals) and income positions aren’t exciting, but they’ve delivered consistently.

Should I follow every recommendation?

The model portfolio assumes you do, which is why its returns are higher than most real subscribers. My dad follows about 15 of the 39 positions and is up 20-25%. That’s the reality gap between model portfolio and real-world results. Start with the “Strong Buy” rated positions and build from there.

Questions about Retirement Millionaire or other investment newsletters? Let me know!

Jenna

Affiliate Disclosure: This article contains affiliate links. If you purchase through these links, I may receive a commission at no additional cost to you. My opinions are based on actual access to this service since November 2021. Review updated February 18, 2026.